Could Joe Biden’s Tax Proposal Mean a 62% Tax Rate?

Candidate for president former Vice President Joe Biden has released his proposed tax plan. Critics warn that, under Biden’s proposal,

Candidate for president former Vice President Joe Biden has released his proposed tax plan. Critics warn that, under Biden’s proposal, top earners in California and New York could end up paying a tax rate of 62%. Is this accurate? CELEB looks into the claim and what the proposal would mean for tax rates.

What Biden’s Proposal Says

Per Investopedia, “Taxes on individual incomes below $400,000 would not increase. New and expanded tax benefits… …including provisions for child care, first-time homebuyers, educational debt relief, retirement savings, health insurance and long-term care could reduce taxes for average families.

The Biden plan would, however, increase taxes for most taxpayers with incomes of $400,000 or more. It would reinstate the pre-2017 top marginal tax rate of 39.6 %, substitute flat-rate tax credits for some deductions, including those contributions to retirement plans. Individuals with incomes of more than $1 million would pay the same rate on investment income as on wages, and equity and hedge fund managers would be subject to ordinary income rates on ‘carried interests.’ In addition, the payroll tax for Social Security would apply to earnings of $400,000 or more (but not between the current wage base of $137,700—$142,800 in 20201—up to $400,000). The estate tax exemption would fall back to $5 million and step-up in basis at death would be repealed.”

The payroll tax would also increase for high earners; “For 2020, the Social Security payroll tax is 6.2% each for the employee and employer on wages up to the contribution base of $137,700 ($142,800 in 2021). Self-employed individuals are liable for Social Security tax of 12.4% on their net profits. The Biden plan would impose an additional Social Security payroll tax of 6.2% each on employer and employee on all earned income of $400,000 or more. Under the plan, no additional Social Security tax would be imposed on wages between the wage base, currently $137,700, up to $400,000.”

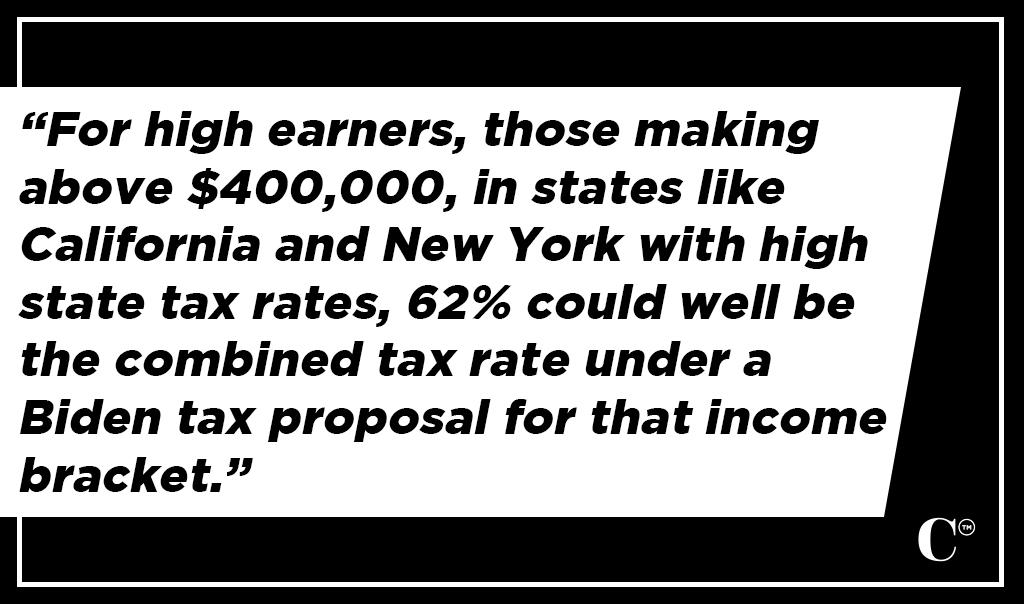

So Where Does the 62% Come In?

Two words: combined taxes. For high earners, those making above $400,000, in states like California and New York with high state tax rates, 62% could well be the combined tax rate under a Biden tax proposal for that income bracket. That rate would include federal taxes, state taxes, and the hiked payroll tax. Reinstating the pre-Trump rate from 37% to 39%, and adding the Social Security payroll tax of 6.2% on top of the current 6.2% is where the increase comes from. Currently, the combined tax rate adds up to approximately 54.8% for those earning over $400,000 in California.

Impact On the Economy

Per the New York Times, “the Times‘s Jim Tankersley and Thomas Kaplan rounded up reports assessing the impact of Mr. Biden’s proposals from the left, right and center. The most noteworthy, perhaps, come from independent forecasters or right-of-center analysts who aren’t predisposed to look favorably on a Democratic candidate.

-

Moody‘s has predicted that if Mr. Biden wins and Democrats control both the House and Senate, G.D.P. would be 4.5 percent larger at the end of 2024 than under current policies, with gains from stimulus spending outweighing drag from tax increases.

-

A group of economists including Kevin Hassett, a former chairman of Mr. Trump’s Council of Economic Advisers, estimated that the long-run impact of Mr. Biden’s plans would cut G.D.P. per capita by 8 percent over the next decade.

-

The right-leaning American Enterprise Institute suggested the tax plan would shrink the economy by only 0.16 percent over the next 10 years, because it would largely tax the savings of high earners who are not big drivers of growth. Still, the proposals would discourage investment and hiring, it said.”

So What Does it All Mean?

Those earning less than $400,000 can choose between Trump and Biden knowing that they are unlikely to see a large change in taxes either way. A minor change would occur if Biden could pass his proposal as written, but that rarely happens with tax bills. So for those who earn less than $400,000, they are unlikely to need to take taxes into account when making a choice. However, for those making over $400,000, especially in states like California, New Jersey, or New York, the possibility of a hike in taxes will weigh heavily on their minds going into Election Day.

62% sounds like- and is – a large percentage, but since the current rate is around 55% for the same group of earners, it may not be a deal-breaker. Those affected by the increase in taxes and additional payroll tax only make up about 1.8% of American taxpayers, so it remains to be seen if Biden’s proposal will scare off enough voters to make a difference.